From billion-dollar swings to bungled city budgets, these real-world Excel errors reveal just how risky the wrong process can be.

Budget season déjà vu? You’re not alone.

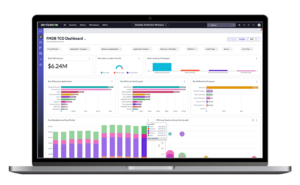

In our eBook, Confessions of Spreadsheets Anonymous, we take a practical look at why planning often feels stuck in a loop—and what it takes to get out. The message is clear: spreadsheets aren’t the enemy, but they’re no substitute for purpose-built software.

Still not convinced? Consider these seven spreadsheet “confessions.” They’re not hypotheticals. These are all publicly reported cases—errors that cost millions, forced resignations, shook public trust, or just flat-out embarrassed entire organizations. If any of these sound familiar, you’re not just reading stories. You might be reliving them.

1. Fidelity Magellan’s Missing Minus

At one of the world’s largest mutual funds, a year-end dividend calculation went spectacularly wrong. An accountant transcribed a $1.3 billion capital loss into a spreadsheet—but missed the minus sign. The spreadsheet interpreted it as a gain, resulting in a projected dividend payout of $4.32 per share.

Shareholders were notified, expectations were set, and market enthusiasm grew—until the fund reversed course. When auditors uncovered the error, the distribution was pulled entirely. The $2.6 billion swing wasn’t just a financial misstatement; it was a public embarrassment for a firm known for precision and discipline.

Behind the scenes, the problem stemmed from a simple but dangerous setup: a manual data entry process with no fail-safe. A minus sign—small, easy to overlook—exposed how spreadsheet-based processes can fail at scale, even in the most controlled environments. For finance leaders, it was a loud wake-up call about trusting critical outputs to unvalidated inputs.1

2. State School Funding Overstatement

A state education department acknowledged an Excel formula error in the model used to communicate district allocations, overstating K-12 funding by more than $201M across two fiscal years. Officials stressed actual payments followed the enacted budget, but districts and legislators were blindsided by the discrepancy. The fallout: bipartisan frustration, emergency fixes, and renewed scrutiny of spreadsheet-driven calculations in public finance.2

3. RedEnvelope’s Forecast Surprise

Online retailer RedEnvelope warned of a sudden quarterly shortfall after a budgeting spreadsheet mis-keyed a single cell, wildly inflating expected margins. The market reacted instantly: shares fell more than 25% in one trading day, and the CFO resigned. One miscoded number in a planning model cascaded through cost forecasts, showing how fragile financial guidance can be when it rests on manual spreadsheet inputs.3

4. City Budget Double-Count

At a Britton city council meeting, officials disclosed that the tax request—around $534,000—had been added twice in the budgeting spreadsheet. Auditors missed it too. The mayor summed up the impact plainly: the city has less to spend than expected, and near-term cash for bills is now uncertain. One copy-and-paste mistake left an entire spending plan suddenly out of balance.4

5. Fannie Mae’s Equity Correction

While implementing a new accounting standard, Fannie Mae relied on a spreadsheet model to value commitments tied to mortgage-backed securities. But a faulty formula in that model overstated shareholder equity by approximately $1.1 billion. The error also inflated assets, unrealized gains, and portfolio balances before being detected during a routine review.

The company called it an “honest mistake”—and it likely was. But the implications were serious. Fannie Mae had to restate financial disclosures and faced heightened scrutiny from investors and regulators. The cause wasn’t data entry—it was flawed logic embedded deep in a spreadsheet used for enterprise-level valuations.

The incident served as a wake-up call: even when intentions are good and models seem sound, unchecked formulas can quietly distort numbers on a massive scale. Without rigorous review, a single spreadsheet can shift the foundation of financial truth.5

6. Kodak’s Severance Typo

In a quarterly close process, one company’s internal spreadsheet overstated severance expenses by $11 million—all because an extra zero was mistakenly typed into a benefits cell.

The number was only meant to reflect a payout for a single employee, but the inflated value rolled up into official financial statements.

Although no overpayment occurred, the company had to restate its results, triggering both reputational scrutiny and internal reviews. The error revealed a key vulnerability: critical close calculations were being handled in uncontrolled spreadsheets, with no automated checks to catch obvious data-entry mistakes.

This wasn’t just a rounding issue—it reflected a process gap. Finance teams were relying on error-prone manual models at a time when accuracy was under a microscope. The incident served as a vivid reminder that even “small” spreadsheet errors can ripple into large-scale consequences, especially when embedded in complex, high-stakes reporting.6

7. Version Mix-Up in a Town Budget

A Canadian town’s budget package included the wrong summary version, producing errors totaling $307,000 across several line items. After a public meeting, staff issued corrections—transportation funding from $3,000 to $153,000, sustainability from $9,910 to $159,910, and a missing short-term rentals line added. The CAO apologized, citing version control chaos: too many spreadsheets, too many templates, and the wrong file chosen at compile time.7

Spreadsheet Slip-Ups in the Public Sector: A Persistent Pattern

While headline-grabbing spreadsheet errors in the private sector are well known, newer ones are harder to surface. That’s not because the risks have vanished—but because the specifics are rarely made public. Financial disclosures from public companies often use opaque phrases like “accounting misstatement” or “control deficiency,” obscuring whether a simple spreadsheet error was to blame. Internally, many organizations fix and move on, never naming the real culprit.

But in the public sector, where budgets are discussed in open meetings and errors are scrutinized in local media, spreadsheet mistakes are much harder to keep quiet.

While we already looked at Britton City Council’s budgeting error earlier, it’s far from an isolated case. Across the public sector, spreadsheet-driven budgeting processes continue to produce unexpected errors that impact operations, delay decisions, or confuse stakeholders.

Moab City Council encountered this firsthand when a budget amendment was tabled after staff discovered a column misalignment in their spreadsheet. Prior fiscal-year data had been mistakenly pulled into the current budget, requiring the entire packet to be reworked before the council could proceed with a vote.8

Townsend’s Finance Committee faced a more severe case—a nearly $900,000 deficit traced to a single spreadsheet omission. A $131,000 line item had been left out during budget certification, throwing off the totals and jeopardizing timely issuance of tax bills.9

Lincoln Town Council had to revise its draft budget after realizing fiscal-year figures had been mapped to the wrong columns. The resulting overstatements, including inflated school funding, were corrected before adoption—but only after a careful line-by-line review revealed the spreadsheet mapping issue.10

These aren’t isolated accidents. They point to a deeper pattern: when critical financial processes rely on manual spreadsheets, even the most well-intentioned teams are vulnerable to costly, avoidable errors.